How Businesses Can Grow Revenue Through Extending Low-Risk Credit

Organizations are always looking for avenues to grow revenue and profits. One way to do so is by extending credit options to customers in need of financial assistance.

Unfortunately, millions of individuals in the US are unbanked or underbanked. As a result, they have zero credit history with any of the traditional credit institutions. Without access to this important info, businesses face considerable risk in extending credit to these customers with unknown credit histories.

Thankfully, the availability and growing popularity of alternative credit reporting can significantly reduce these risks associated with serving the unbanked and underbanked. Below, we’ll explore exactly how businesses can grow their bottom lines by extending low-risk credit to such customers.

Why Should Businesses Offer Credit Options?

Many businesses don’t realize that extending credit is an effective way to attract customers and build lucrative, long-term relationships.

A Forrester study discovered that credit-offering businesses enjoy a 17% increase in incremental sales as well as a 15% bump in average order values. Having that extra revenue boost makes all the difference in today’s competitive markets, where operating costs are soaring and margins are tight.

Offering credit also improves customer loyalty, as it shows that businesses trust their customers enough to offer them flexible payment methods. Besides, a company capable of offering credit is likely to be well-run, financially stable, and trustworthy—all of which benefits the company in winning more business.

Based on the reasons above, offering credit is highly recommended for helping companies to attract more prospects and close more deals. There is, however, one major concern when offering credit options:

The Problem with Offering Credit Options to the Unbanked and Underbanked

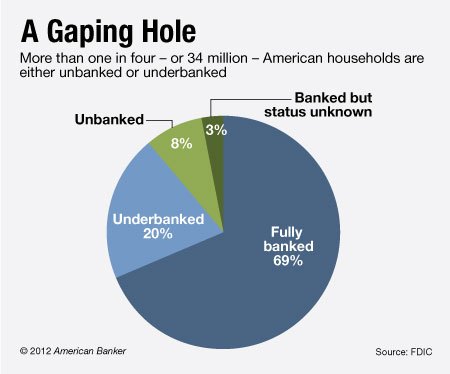

In the US, just over 45 million people have no credit history on file with traditional credit houses. What’s more concerning is that 25% of US households are also unbanked or underbanked, according to a 2017 survey by the FDIC.

The scale of the unbanked and underbanked problem in the US (Image Source).

The unbanked and underbanked are individuals who don’t have bank accounts or lack access to common financial products and services. They may, however, engage with alternative financial services like payday and peer-to-peer (P2P) loans. Some go as far as using only cash in their daily lives, making accounting almost impossible.

This is a problem for businesses wishing to extend credit since dealing with “unknown” customers is risky due to the possibility of fraud or non-payment. Even if businesses decide to take a punt, they don’t know what the best credit option is for credit-invisible customers, potentially leading to bigger losses.

Despite the risks, businesses should not be afraid of extending credit as there are ways to overcome this issue. One way to do so is by using alternative data to gauge the financial standing of credit-invisible consumers.

How Alternative Data Helps the Unbanked and Underbanked

There was once no way for credit scoring systems—including FICO scoring models—to track transactions made by unbanked and underbanked individuals. Things like paying rent, settling utility bills, and other daily transactions were largely ignored, which caused many valid credit applications to be turned down.

That is no longer a concern with the advent of alternative data. Alternative data is exactly what it sounds like—data that is obtained from non-traditional sources to help companies evaluate their customers’ creditworthiness. Some common examples of alternative credit data include monthly payments (e.g. rent, car bills), asset ownership, utility payments, public records and employment history.

Alternative data is useful as it can help gauge the unbanked and underbanked individual’s financial reliability just as accurately as traditional credit data. Alternative data can also be used to complement the credit scores of regular consumers, but for the credit-invisible, it’s the best and only tool they have to secure financing options.

Why Credit-Offering Businesses Need Alternative Credit Data Reporting

Alternative credit data provides a different perspective on a customer’s credit behavior, looking beyond financial service accounts and into other relevant financial habits like paying off rent and loans on time. This gives businesses never-before-seen insights into customer risk, which enables them to deliver smarter, more optimized credit offers to unbanked and underbanked customers.

By leveraging alternative data credit reporting, businesses can improve risk assessment to extend credit to customers with full confidence. Huge revenue growth is possible, as they’re able to tap into a profitable group of prospects that were previously invisible to the market. In other words, they identify golden opportunities where others see risks with the help of alternative credit data reporting.

In an economy that is becoming more crowded and competitive by the day, leveraging alternative credit data to expand one’s portfolio of services is a no-brainer.

How Businesses Can Benefit from Alternative Credit Data Reporting Today with Microbilt

Gathering alternative data is resource-intensive when done manually. To make the alternative credit data reporting process as smooth as possible, businesses should invest in the right technology to help them assess the risks and creditworthiness of the unbanked and underbanked automatically.

MicroBilt’s industry-leading suite of credit and decisioning tools empower enterprises with the insights they need to offer credit options confidently to customers. From leveraging predictive analytics to analyzing customer behavior, to evaluating risk levels, our platform helps businesses make extending credit a risk and hassle-free process.

MicroBilt also offers a variety of credit and risk management solutions across multiple verticals, including payment solutions, identity verification, and debt recovery.

Get in touch with our experts today to find out how we can help your business grow.